Finding The Best Cheap Volkswagen Car Insurance Quote

The average auto insurance cost for Volkswagen cars is around $1,550 yearly or $130 monthly. But there could a number of factors that go into calculation of premiums and so, car insurance rates are likely to vary from driver to driver. Age, gender, the make and model of Volkswagen car, residential location, credit histories as well as past driving records of drivers can dictate the overall affordability of Volkswagen car insurance rates offered by insurers.

Volkswagen cars are available in numerous makes and models. These are all big vehicles that have advanced safety features and they are popular among teen and all categories of drivers in America. Among all the range of Volkswagen vehicles, various golf models – Golf, Golf Alltrack, Golf GTI, Golf R and Golf Sportswagen are among the most sought after cars. Besides, there is the GTI, Jetta, Passat, Routon, Tiguan, Tiguan Limited and Touareg which are all high performance vehicles that catch drivers’ fancy across America.

Aliasinsurance.com can assist you to get and compare the best cheap Volkswagen auto insurance quotes online and make shopping easy.

Table of Contents

ToggleHow Much Coverage Levels You Will Need To Insure Volkswagen

The insurance rates that are provided for your Volkswagen car will depend on the level of coverage which you want. To that effect, it is vital that you determine your exact coverage needs before you proceed to apply for free quotes online with different insurers. In addition, you may also have to consider possible out-of-pocket expenses which might have to bear if your Volkswagen vehicle gets damaged because of an accident or stolen while assessing your coverage requirements. Every state prescribes minimum liability coverage that drivers must carry for driving cars legally on road. Find out what your state demands.

A policy with basic or minimum liability coverage will be the cheapest alternative for you. Such a car cover may have the below mentioned features.

- Bodily liability injury cover – Coverage pays medical bills for other drivers and third party victims if they suffer from bodily injuries due an at-fault accident involving the insured car.

- Property damages liability cover – – Coverage pays costs damages caused to other driver’s or person’s property because of an at-fault accident involving the insured vehicle.

- Personal injury/Medical payments cover – Coverage pays expenses for medical payments incurred by driver and fellow passengers in the insured vehicle if they suffer from bodily injuries during an accident.

- Uninsured/under insured motorist cover – Such coverage will pay medical bills and property damages incurred by an uninsured or underinsured motorist who meets with an accident with the insured car.

- Comprehensive cover – Coverage will pay damages for losses caused due to insured car getting stolen or badly damaged on account of vandalism, rioting, etc.

- Collision cover – Coverage will pay damages for losses caused due to your insured car hitting an animal, falling object(s) like tree(s), winds, storm, etc.

- Glass cover – Coverage will pay costs for replacement of windshields, both front and rear, if they get damaged because of any kind of reason.

- Gap insurance cover – Such type of coverage feature will pay the difference between cost of the new replaced vehicle and unpaid loan amount of a car under finance which gets totled in an accident.

And if you are getting a Volkswagen car on lease to go outstation for business or house related work then you may have to buy full coverage insurance. There is higher probability of your leased car meeting with an accident in areas where there is too much traffic. You need to take all such things into consideration while evaluating your Volkswagen auto insurance coverage requirements.

It is then time to get multiple free quote estimates from top rated insurance companies and compare them to locate the best and cheapest quote.

Factors That Affect The Overall Affordability Of Volkswagen Insurance

- Age and driving record – Volkswagen golf insurance 17 year old driver rates will be higher than those offered to any other category of drives. This is primarily on account of the fact that 17 year olds have the least driving experience and their tendencies to drive cars recklessly can result in higher probability of meeting with accidents. And as a 17 year old driver, you may hardly have established any driving record so, insurance companies are not in a position to assess coverage risks. This leads to high premiums.

- Annual number of miles – The other major factor which will impact VW car insurance rates is the car’s annual mileage. If you are going to drive more than 15,000 miles during the year then you can expect to pay more for insurance. Against the annual average mileage of 10,000 to 15,000 miles each year that most Americans drive, anything above that increases the coverage risks for insurers as chances of meeting with accidents are high. That results in higher premiums

- Car’s existing market value – Your Volkswagen’s make, model and year of manufacturing greatly influences insurance rates. Accordingly, older VW versions will be worth significantly less than newer and more sophisticated models. So, the insurance rates provided for a 2010 Volkswagen car will be much lower than those offered for 2020/2021 WV model. You must know that every Volkswagen model has unique coverage needs and therefore, the premiums will vary. Learn about current trends in Volkswagen auto insurance rates today!

Average Insurance Costs For Insuring Volkswagen Vehicles Online

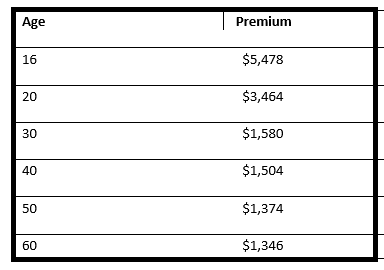

On an average, a full coverage Volkswagen car insurance policy for a 40 year old driver costs $1,504 for a year or $125 monthly. But for high risk drivers, the same may cost $3,250 per year and drivers in teens may pay even higher. VW golf insurance for 17 year old drivers’ cost can be about $5,478 or even more depending upon individual driving records. However, by choosing higher deductible, the overall Volkswagen insurance costs can be brought down drastically.

Average full coverage Volkswagen rates with $500 deductible by age.

Nevertheless, if you have undertaken modifications in your Volkswagen vehicle then you will have to notify that to insurers and premium levels would further increase. In addition, your residential area can also play spoil sport if the geographical location has high crime rates. And as all Volkswagen cars have higher safety ratings, it will help in lowering of insurance rates.

Insurance carriers even provide discounts on premium to qualified drivers. If you can manage to qualify for these premium discounts, you could end up saving lot of money on premium. This could be possible by maintaining a clean driving history and having good credit ratings. There may be many such things which you need to be aware of for saving additional dollars. Talk to an expert now!

Coverage Options For Volkswagens To Get Full Financial Protection

Rather look for cheap Volkswagen golf insurance 17 year old or any other age group driver’s option, it is worthwhile to make sure that you are fully protected in the event of any fateful occurrence on road. Drivers must not just buy minimum liability coverage mandated by their states but should also consider purchasing additional coverage features like Personal Injury Protection (PIP) and Personal Liability Protection (PLP) especially if they are living in states that have no-fault system in place. And even those drivers that reside in other states can invariably benefit by buying optional VW vehicle insurance coverage features.

If budget is not an issue then in the first place you could think of purchasing a full coverage VW auto insurance policy. Such type of a car cover will include comprehensive and collision coverage features that can grant complete protection to your finances if your vehicle gets damaged due to any other reason other than an accident. Next, if you are planning to get a Volkswagen car on lease or on loan then having a gap insurance coverage feature added to your policy can help you to get the cost of leased or financed car replaced or reimbursed with cost of a new car if it gets totled in an accident. In such a case, you won’t have to spend anything from your pocket.

Thus, insurance companies provide an array of extra car coverage options to drivers. If your current insurer doesn’t offer you additional coverage alternatives then you could think of switching over to new insurance company which provides such options. It will go a long way in ensuring that your finances remain protected from any kind of eventuality involving your Volkswagen vehicle. To determine the right course of action, fix free consultation with our independent agent online!

Here Are Important FAQs

Volkswagen is pretty expensive to insure, but not in comparison with other cars. You can compare the cost of insurance for different makes and models of car to see which car will be cheaper to insure than a Volkswagen.

The average cost of car insurance for a Volkswagen Golf is $1548 a year or $129 per month

About The Author

Andy Walker is a freelance content writer who specializes in writing for insurance and finance related niches. He has years of experience in this field and has written extensively on a variety of topics. Andy’s work is always highly polished and well-researched, ensuring that his clients are always happy with the results.